How Asset Correlation Works

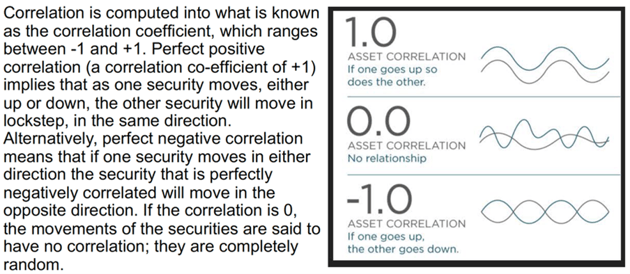

Correlation is a measure of one asset’s price action relative to another asset when a catalyst is introduced.

If they both price in the same direction at the same time, they are considered to be positively correlated. When one asset tends to move up when the other goes down, the two assets are considered to be negatively correlated. Assets that don’t show any relationship to each other are said to be non-correlated.

Often, investors will group funds and ETFs from popular fund managers together to differentiate and diversify their portfolios only to find the funds they’ve chosen own many of the same names. This becomes evident when seemingly diversified asset classes tend to all rise or all fall with the economic tide.

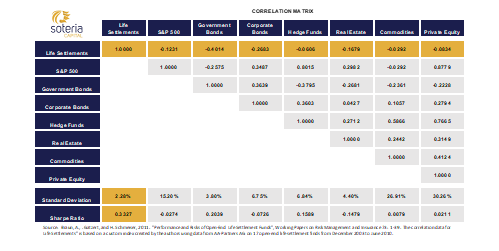

Diversify with Non-Correlated Returns

Senior Life Settlements are an answer to balancing volatility risk in your portfolio with highly non-correlated absolute returns. A diversified portfolio of life insurance policies produces non-volatile yield because there’s no relationship between a life insurance policy and anything else other than the longevity of the insured. A life insurance policy is always worth its face amount…no more…no less.

Over the course of time, maturity proceeds from death benefit payments flow through to subscribers as they occur. With a reinvestment of maturity proceeds as your portfolio seasons, life settlements can produce a differentiated stream of income well into the future.