Most investors understand that diversification is an important element of reducing overall portfolio risk, but there are different aspects of how asset classes relate to each other that are often overlooked. One critical measure of risk in asset allocation is Correlation.

Asset correlation is a measure of one investment’s price action relative to another investment when a catalyst is introduced. For instance, what happens to the price of Stock ABC and Bond XYZ when the Federal Reserve raises the overnight rate by a quarter of a percentage point?

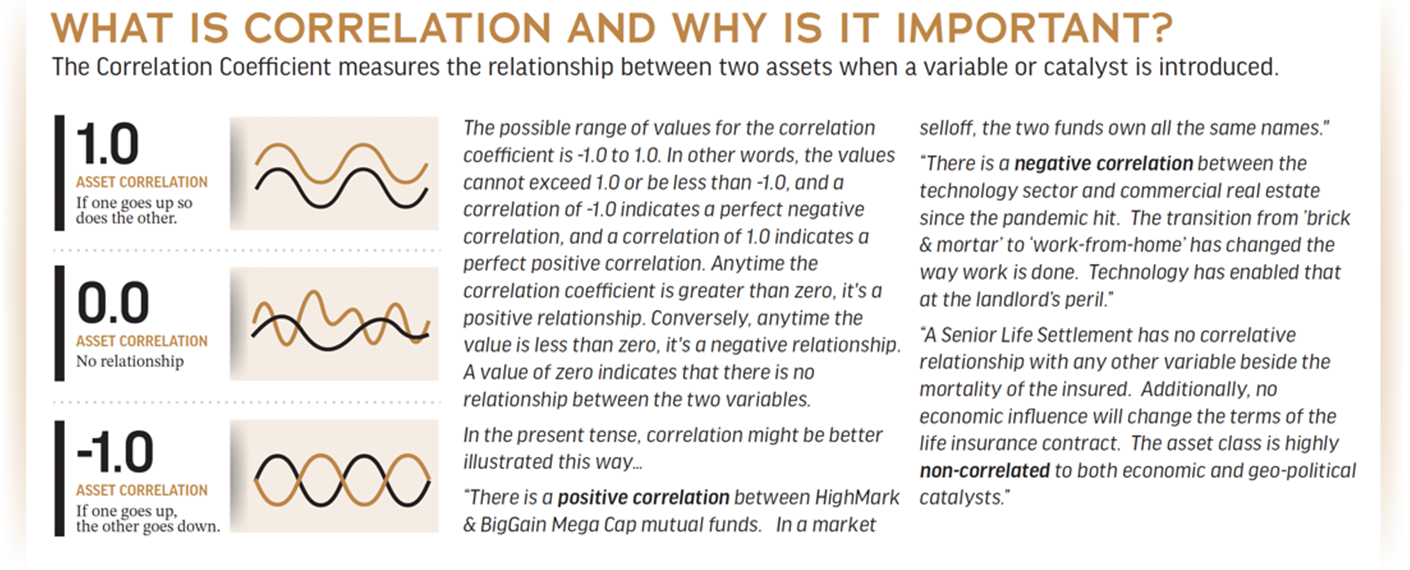

How Asset Correlation Works

If they both price in the same direction at the same time, they are considered to be positively correlated. When one asset tends to move up when the other goes down, the two assets are considered to be negatively correlated. Assets that don’t show any relationship to each other are non-correlated.

Diversify your portfolio during volatile economic times like these with asset class correlation in mind.

Diversify with Non-Correlated Returns

Senior Life Settlements are an answer to balancing volatility risk in your portfolio with non-correlated absolute returns. A diversified range of life insurance policies produces non-volatile yield because there’s no relationship between a life contract and anything else other than the insured.

Over the course of time, maturity proceeds from policy death benefits flow through to subscribers as they occur. With reinvestment of maturity proceeds as your portfolio seasons, life settlements can produce a differentiated stream of non-correlated income well into the future.